Category Archives: College Life

Student Budget Tips

The reason why many students struggle financially is that they are out on their own for the first time, without their parents to pick up the tab. Even if student accommodation is paid for, spending money has to be well managed and monitored. Some students have jobs and some rely on loans, but no matter how they are funded budgeting is an important necessity for any student.

However, there are many budget hacks which students can use to make their dollars go further. Let’s have a look at some great ways to do just that.

Textbooks

Textbooks are something which students cannot go without, but buying new isn’t the only option. Instead of putting large amounts of cash on new textbooks, students can look to rent them from the library, find a downloadable online version or buy the books second hand. However, if you buy second hand from last year’s students, be sure that it is the latest version of the textbook.

Coupons and Deals

If you are going to go drinking then happy hour is the perfect time to do it and it is critical that you take advantage of as many savings and promos as you can. The same thing goes for grocery shopping, there are loads of coupons which you will find online, that can help you to save some serious cash on the essentials.

Paying the Bills

If money is tight then it is important that you don’t lose money unnecessarily. One way that can happen is if you don’t pay bills on time. A late payment fee can be very expensive for someone who is trying to watch their money. The same goes for interest payments on credit card bills. Stay organized and pay those bills early.

Buy a Bike

A bike is going to be a very smart investment and although you may feel as though you are shelling out some money, the savings over the long term will make it worthwhile. Most universities are well placed and you’ll find that many places you go to are within cycling distance. This will save you huge amounts on public transport and cabs.

Buddy Up The Bills

Don’t take on all of the bills in the student accommodation you are sharing, work with your roommates to split services up. For example, if you are going to get music and TV streaming services then take one each, this way you can all enjoy it without one person footing the whole bill.

Student Discounts

Student discounts are there to help and support you, make sure that you take advantage of as many as possible. Most students fail to do this because they simply aren’t aware of them. There is plenty of information online which you can find that will point you in the direction of all student deals available to you.

Finally the key to saving money during your time in uni accommodation is to be aware of all the money that you have coming in and out. The moment you begin to ignore it, is the moment that you will overspend.

Where Does Your College Tuition Actually Go?

College tuition is one of the things that many people have concerns about but don’t actually know a lot about. Of course, if you’re currently in college or interested in attending college, you’re more than likely going to have to pay at least some of your college tuition. The changes and growth in tuition have become a huge political and social discussion, especially in the last few years. However, even with all this discussion, you might not know a lot about college tuition. Here’s what you need to know about what your college tuition pays for.

College tuition is one of the things that many people have concerns about but don’t actually know a lot about. Of course, if you’re currently in college or interested in attending college, you’re more than likely going to have to pay at least some of your college tuition. The changes and growth in tuition have become a huge political and social discussion, especially in the last few years. However, even with all this discussion, you might not know a lot about college tuition. Here’s what you need to know about what your college tuition pays for.

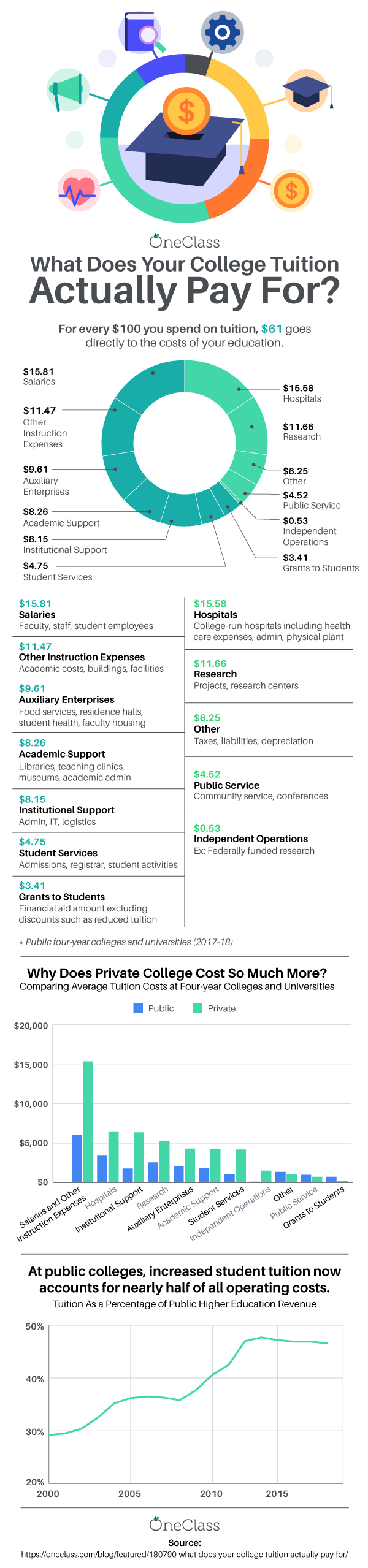

A Full Breakdown of College Tuition Spending

The United States Department of Education collects a variety of information on the ways in which colleges spend their money. By dividing college spending into a number of different categories, you can get a better understanding of the college’s priorities.

However, these numbers don’t always get the point across in the easiest way. You may want an easier breakdown of the ways in which colleges spend the money you pay them. Possibly the best way for you to understand is to consider the way a college would spend $100 of your money.

$61.46 of this $100 would go to direct education costs, which would play out like this:

$15.81 – Salaries

$11.47 – General Instruction Expenses

$9.61 – Auxiliary Student Enterprises

$8.26 – Academic Support

$8.15 – Institutional Support

$4.75 – Student Services

$3.41 – Grants and Financial Aid

These direct education costs are necessary for your college to function and provide you with the services you have available.

The other $38.54 of this $100 is less direct university costs, which typically plays out like this:

$15.58 – Hospitals and Healthcare

$11.66 – Research

$6.25 – Other, Including Taxes and Liabilities

$4.52 – Public Services

$0.53 – Independent Operations

With these two things combined, your university is able to function above and beyond just the basic functioning system that you expect from a college.

Private and Public College Tuition

The difference between private and public college tuition tends to be many thousands of dollars per year. According to the College Board, on average, private school tuition, fees, room, and board costs $27,920 more per year than public school, adding up to $111,680 more for a four-year degree.

There are also differences in where public and private schools use that tuition. Salaries and other instruction expenses tend to be about 2.5 times higher for private schools than public schools, matching up well to the 2.2 times higher tuition tends to be. However, grants to students are actually less widespread with private schools; public schools spend more than three times the amount that private schools do.

Conclusion

College tuition is different for every school across the country. When you look at just an aggregate average, you won’t be able to tell exactly what you’ll get from an individual college. However, one thing you will get is information about how school is becoming less affordable for most college-age students. Regardless of what you think the best choice for college tuition is moving forward, having this information can be incredibly useful when you start to talk about it with other people.

College’s Striking Impact on Students’ Bank Accounts

It’s pretty well-known that college isn’t easy on your bank account. After all, without rich parents or a great scholarship, you’ll likely end up with thousands of dollars of debt that may take you many years to pay off. But in the short term, while you’re still in college, it may actually continue to have an impact on your bank account. OneClass recently completed a survey regarding students’ bank accounts, and whether you’re currently a student or you just want to know more about student finances, there are some interesting takeaways.

It’s pretty well-known that college isn’t easy on your bank account. After all, without rich parents or a great scholarship, you’ll likely end up with thousands of dollars of debt that may take you many years to pay off. But in the short term, while you’re still in college, it may actually continue to have an impact on your bank account. OneClass recently completed a survey regarding students’ bank accounts, and whether you’re currently a student or you just want to know more about student finances, there are some interesting takeaways.

The Data by the Numbers

The study had a few different questions, mostly to try and map demographics, but the crux of the survey was a single question: How much money is in your bank account right now? This number included both checking and savings accounts. Here’s the raw data to that set of responses.

- 13.5% responded $0-50

- 22.8% responded $51-$500

- 10.5% responded $501-$1,000

- 10.3% responded $1,001-$2,000

- 20.1% responded $2,001-$5,000

- 13.0% responded $5,001-$10,000

- 9.8% responded $10,000 or more

These numbers already showcase some interesting concepts, but it can be hard to truly understand a survey with just the numbers. What do these numbers really mean?

A Substantial Chunk of Students Have Less Than $50 in the Bank

Looking at the numbers, you can see that 13.5% of all students who took the survey said that they currently have between $0-$50 right now. This is a pretty startling number — it’s barely enough to cover a dinner at a casual dine-in restaurant.

It’s true that this number could potentially not tell the whole story. After all, a student taking the survey may have just paid off large bills right before a paycheck. But the fact remains that over one out of eight people who took the survey reported this number, which is a pretty substantial amount.

Over a Third of Students Likely Couldn’t Cover a Surprise Expense

In its assessment of the United States’ financial wellbeing, the Federal Reserve asks a simple question: If you had to pay for a surprise $400 emergency expense tomorrow, how would you pay it? This is relevant because of the sheer number of people who responded that they currently have $500 or less in their banking accounts — definitely not enough to cover any sort of significant expense.

Altogether, 36.3% of students responded that they didn’t have more than $500. Though this statistic may not jump out to you as much as individual measurements, it’s an important one because it has to do with preparing yourself for an emergency. It’s definitely worrisome, regardless of antecedents that may have an impact on the responses.

Most Students Don’t Have Enough for an Emergency Fund

An emergency fund, according to most experts, should be enough to cover 3-6 months of expenses. This emergency fund could cover a person if they were to lose their job abruptly or experience an unexpected medical incident. But that adds up, and 3-6 months is definitely at least $5,000 in most areas. The fact of the matter is, most students just don’t have that much money.

77.2% of students, which is just over three-quarters, reported having $5,000 or less in both their checking and savings accounts. That means it’s not exclusively money stored away for use in case of an emergency. With that many students unprepared for a crisis, it’s definitely sobering to think about other collegiate expenses.

Conclusion

Certainly, some antecedents could have contributed to the results of this survey. After all, you can’t control for everything or ask every question about students’ finances. But it does give an important general conceptualization of students’ current financial wellbeing. What can you learn from this study? If you’re a current college student, it showcases how important it is to focus on maintaining your finances well. If you’re interested in going into college, it offers some insight into how important it is to build up a safety net of savings. Either way, you should definitely take heed of this information.

Knowing what to study as an adult

After several years of being in the work world, you are likely to find yourself in a position where you are wanting to move jobs, get a promotion or start your own business. It is definitely a period of change and a deepening of understanding which direction you want to go into. It is often the pivotal point in your long-term career, where you have built some experience and have had some exposure but not if you’re ready to forge a clear way forward. It can be hard knowing what to go on to study that will equip you with what you need to make the next move. Here are a few ideas to picking your next learning pathway.

Project management course

You can do a diploma in project management because project management is underlying that supports just about anything you do in business and in your job. Having good project management will help you know how to manage people, manage budget and prioritise and execute tasks. You can choose whether to do your course online or through a university or college, but make sure that it is a recognised certificate or qualification that you can use to improve your resume.

Business acumen ability

Being in business you will want to have a better understanding of how business works overall, whether it be how money is made, money flows through the business or how the practice of management strategies, such as lean management can help improve cash flows and profits. There are several courses that can help develop your business acumen. Popular ones would be a diploma or master’s in business administration and while the name is a bit misleading, you will learn the basics of all aspects of business. This includes marketing, economics, accounting, and even human resources and logistics.

Go industry-specific

Depending on what industry you are in and what direction you are wanting to go and grow into, your further learning may be best suited around doing something that is industry-specific and helps. It could stand you in a good position if you’re looking to improve or motivate for a bigger paycheque because if you’re better skilled and qualified in your position, you will be highly valuable to your company.

General short courses

There are tonnes of short courses available online which don’t necessarily have the credibility of a university or college but do offer comprehensive learning tools to learn a particular skill. This could be a great way of identifying and boosting your skills and knowledge in something like software skills or in public speaking. The range of what is available is vast and you can almost do just about anything. Try to find a way to map your skills and identify the areas that you are lacking. Speak to your colleagues and bosses about what they’d like to see you do better at and find a course that can address that. The cost of these courses can be incredibly low because they work on a model of scale.

What exactly is a mini-MBA?

It is often said that learning the language of business and understanding the thought process of it, is the secret to success. Which is why, the perspective of current generation prospective MBA students are changing, seeking for a flexible mode of study, like a mini MBA. This is typically an accelerated business program, with an emphasis on the specific needs of students.

Although not an alternative to a full-time MBA programme, it is definitely a great way of topping up your business knowledge and enhance your portfolio. Besides introducing you to a broad range of business areas, the mini MBA programme will help you gain a good grounding of the key strategies, leadership issues and the latest trends in business. This blog will help you explore mini MBA in-depth and provide you with the reasons why you should choose to study it.

The Mini MBA refers to a fast-track format of the MBA, concentrating the one or two years of the content of a regular MBA into around 28 hours (four days) of tuition. It provides students with an overview of the business landscape and how all the operations work together. A mini MBA programme is structured to provide an introductory insight into business, preparing students for further exploration of the field of business administration.

This concentrated, informative training (usually on a specific topic) will help you gain a foundational understanding of that particular area, then moving on to focusing on a different topic each week, such as finance, business ethics and leadership. Such MBA courses not only assures students of acquiring employment after graduation but are also significantly cheaper, with tuition fees starting around £2,000.

A mini MBA is geared towards offering prospective full-time MBA students the chance to understand the true meaning of a business degree before fully committing. Basically giving students a more comprehensive understanding of what an MBA involves. Candidates who are looking to enhance knowledge in a specific area, a mini MBA will be an ideal choice for them, as these courses are more specialised-focus than a full-time MBA.

This type of MBA is also apt for students who are looking to enhance their own business competency while remaining active in a specific role. The skills acquired through a mini MBA will not only benefit your personal and professional development but also improve your performance in the workplace. You will become capable of managing yourself and other individuals professionally, as well as lead high-performance teams.

Employers, nowadays, are increasingly drawn towards hiring mini MBA graduates, who are expected to possess enhance management skills and the right business acumen. If you want to develop your business understanding of a specific industry, then applying for a mini MBA can help you achieve that.