Tag Archives: money

Banking More Effectively With Student Debt

When you have student debt, it’s going to impact your entire life. However, many people don’t fully understand how they can manage student debt, and especially not how they can do it through elements like their bank account. As a matter of fact, the bank account you choose could have a direct impact on your student debt, and choosing the right bank account could be the key. Here are four things to do when it comes to banking with student debt.

When you have student debt, it’s going to impact your entire life. However, many people don’t fully understand how they can manage student debt, and especially not how they can do it through elements like their bank account. As a matter of fact, the bank account you choose could have a direct impact on your student debt, and choosing the right bank account could be the key. Here are four things to do when it comes to banking with student debt.

Understand Direct Deposit Benefits

Many bank accounts push direct deposit, with some of them giving access to a kind of “rewards program” when you add direct deposit to your bank account. Direct deposit is a way to get money directly from one bank account to another, and in this case, it typically has to do with your job. Usually, if you give your direct deposit information to your boss, they can directly deposit your paycheck. Use it to your advantage to get more from your banking experience.

Check for Minimum Monthly Balance Requirements

Many people with student debt have very low amounts of disposable income, often because they’re funneling a lot of their income into paying off student debts. In these situations, even monthly balance requirements as low as $400 or $500 can be insurmountable, sometimes causing people to have to take on fees just to keep their account open. It’s a much better idea to opt for an account that doesn’t have any minimum monthly balances.

Look for Information About Fees

Fee information can be what makes you decide whether or not to sign on with a specific bank. Many banks are doing away with a lot of fees, including overdraft fees and monthly maintenance fees. These fees just cut into your monthly paycheck, and that can be extremely frustrating. Instead of just dealing with the regular fees, it might be a good idea for you to find a bank account that doesn’t charge you any of these fees.

Find the Best Sign-On Bonuses

An ideal bank account isn’t just about avoiding bad elements of accounts; it’s also about actively pursuing the good elements. Sign-on bonuses can be a great way to save more money through your bank accounts, because it’s often like basically getting free money – many banks don’t require a lot of prerequisites for sign-on bonuses. If you want the best sign-on bonuses, you’ll want to look into a Sofi bank account, where you can find full reviews of some of the best sign-on bonuses in the industry.

Conclusion

One of the most important things to do when you’re paying off student bills is to make sure that you’re banking as effectively as possible. It’s not always easy to do, but it’s also not as difficult as it may initially seem. Bank accounts are extremely varied nowadays, and there are plenty of ways to find a good one. No matter how much student debt you have, the right bank account can be a great way to minimize its impact on your life.

Are you a Smart Shopper? 7 ways to save money using credit card and coupon deals.

When people think of saving, the first thing that comes to mind is reducing their expenses. However, smart shopping doesn’t always mean cutting back on expenses. With the right approach, you can save more without having to sacrifice anything. Here are a few tips on how to maximize savings while shopping using credit cards and coupon deals.

Credit cards? Choose Carefully.

Before you decide on the service to use, it is important that you understand your expenditure and choose a credit card that best suits you. Check your credit score with the knowledge that a good credit score makes you more eligible for cards that offer better perks. Find a credit card that is best suited to your goals which might be to save, to build (or rebuild) your credit score, or to earn rewards.

Pay early, pay in full.

Whenever you can, paying off your credit card debts on time and in full can save you a lot of charges on late fee expenses. It also has the added benefit of improving your credit score rating, giving you access to lower interest rates. One trick is to link a savings account to your credit card so that the outstanding can be automatically debited monthly and on time.

Always ask.

More often than not, you can get lower interest rates on your credit cards simply by asking. This poll found out that 65 % of people who asked for lower interest rates succeeded. Also, 86% of people were able to get their late payment fees waived simply by asking.

Reward programs and price protection.

Several credit cards offer different reward programs – cash back, points based or frequent flyer miles. Take advantage of it, only if you can pay your balance in full. Rewards often come with higher interest rates so it would only make sense to get these rewards if you are able to pay your balance in full.

Organise your coupons.

It is easy to forget where you stashed your coupons only to find them later when they are expired. In the same way, you can easily lose or forget your coupons and miss out on a good deal as a result. Keeping your coupons highly organised will make saving easier for you. Learn to stockpile your coupons for even better savings.

Find coupons in the right places.

Be vigilant. It is easy to overlook easy and free places to find coupons. Always check for products that carry coupons while doing your regular shopping. If you are in a store that offers in-store magazines, remember that these often carry coupons so always pick more than one to get extra coupons. Websites that offer printable coupons are also a great source for great savings.

Patience is good.

When you find coupons, the goal is not to use them as soon as possible. Wait until you are sure you have the best deals before you use your coupons. Super savers tip – If you have wind of an upcoming sale, then combining coupons with sales will help you make even better savings.

Don’t Let Bad Credit Get in the Way of your Student Loan

Becoming a student brings many challenges with it, but perhaps none greater than the issue of finance.

Getting used to living alone, trying to budget for food, accommodation, and a social life, while also getting to grips with your studies can feel like a huge mountain to climb, especially if you have no financial support.

If you have bad credit, it can feel impossible to get a grad student loan to help you through your college life, but it does not have to be this way.

Getting a student loan with bad credit and without a cosigner

In order to receive student finance from many companies, especially if you have bad credit, you will need a cosigner, someone who can act as an insurance policy on your loan. Unfortunately, not everyone has access to someone with a good enough credit history to cosign a loan for them, and that can lead to serious financial difficulties.

But there are companies out there who understand, and offer a service especially tailored to the needs, and to the problems of those with bad credit.

With modern technology being where it is, sites like Student Loan Corp can give you information and assistance with no cosigner student loans.

This is the best way to get student loans for those with bad credit, and without someone who can cosign their application.

Managing your money

Obviously, a bad credit student loan is a risk, like any other loan, but as long as you are sensible with the way you manage the money you receive, you can ensure that you get the help you need from your student loan, without any problems arising.

There are two main points of focus when it comes to money management.

- Prioritize – Your college years are as important for personal growth as they are for your career opportunities, so, obviously, you should maintain a social life, but be sure not to let this become a financial burden. Pick certain events that are affordable, and make sure you have budgeted for all food and bills for the week before deciding what to do.

- Plan – Spontaneous ideas are great sometimes, who doesn’t want to take an unplanned road trip to the beach every once in a while, but aside from such moneys, the more meticulously you plan where your money goes, the further you will find it stretches. From food and bills, to social occasions, sporting events, to Christmas and birthday presents, every time you can plan where money is going to go, do so, then you are less likely to have to deal with unexpected surprises.

Related: Student Loan Calculator

Having bad credit does not have to mean you will not get approved for student loans, not with services now available for those with bad credit and/or no cosigner.

Graduate studies are vital for many people around the world, and the financial difficulties of your past should not keep you from yours, and now they will never have to.

You might also enjoy: How to Save Money in College

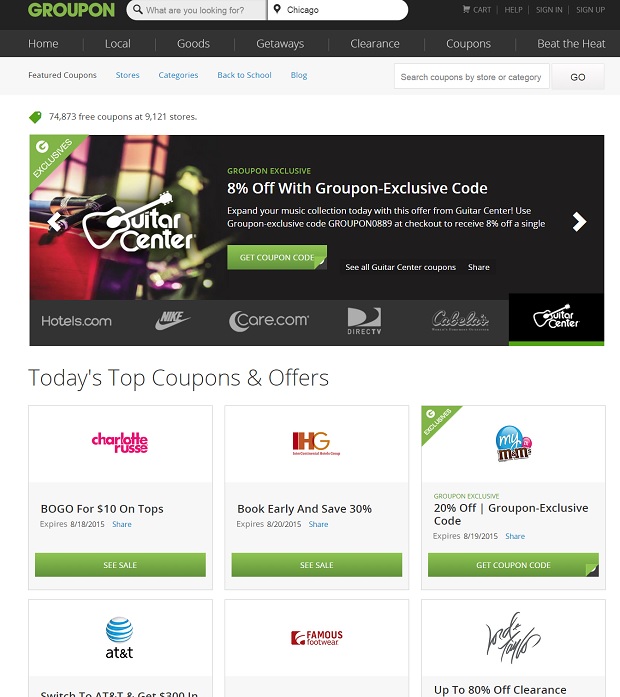

Save a Sh*t Ton of Cash With Groupon Coupons!

If you haven’t checked out Groupon Coupons yet, you’re missing out! For students it’s a godsend with over 70,000 coupons from 9,000 retailers. You can save big on everything from a new computer from ASOS to new kicks from Foot Locker.

There are an astonishing 70,000+ coupons available and lots of different ways to save some extra beer money on something you might need/looking for from clothes to school supplies and everything in between!

you can also save a ton on travel from flights to hotels. Head to the Coupons tab on the Groupon website to start taking full advantage of all the money-saving benefits.

5 Ways Students Can Save Money

With in-state tuition for public universities approaching $10,000 these days, and other costs like housing and books escalating in lockstep, it has never been more important for students to save money while at school.

While it is easy to just use credit to charge all these expenses, the bill will come due someday soon, so you owe it to your future self to not cripple yourself with an unmanageable debt load. As such, here are five ways students can save money so that they can give themselves a brighter financial future, as well as more disposable income for the important things in life.

Like beer.

And video games.

1) Take on roommates

While you might crave privacy after 18 years of living at home with your parents, the unfortunate reality is that college is more expensive than it ever has been. The good news is that you get to choose who you are sharing a living space with, making for a living atmosphere that will be much more lively than if you were to go it alone. This will divide your house or apartment rent to a level that will allow you to enjoy a diet that consists of more than ramen and water.

2) Cook meals with friends

When you share a house with friends, another opportunity to save your precious cash presents itself. Instead of cooking meals individually, you can take turns making meals for each other. This will require coordination when it comes to shopping at your local supermarket, but once you settle into a groove, you will be spending less per person, eating better than you would individually, and the kitchen will be less crowded. So much win!

3) Order as much as you can online

The internet age has made our lives so much easier, with no better example than online shopping. Why burn gas and time running all over town to buy the things you need for school and life when you could just click a few buttons and wait for it all to come to you?

If you want to save money on school supplies, this is the perfect way to do things in 2015, as many coupon sites allow you to spend even less than the already reasonable prices listed, and with many deals waiving shipping charges, you can spend the time you just saved playing Call Of Dut- … er, I mean, studying for that stats term paper coming up. Yeah, that’s right.

4) Have house parties instead of going out to the bars

With prices for booze escalating with every passing year, going out to the bars is a fun pastime that composes an ever-larger chunk of student budgets. While heading out to a venue out on the town is always a great time, the whole point of drinking is to have a killer time with your buds.

Why can’t you do that at home at least some of the time? Buy a 30 pack of PBR or Natty Ice, organize a playlist of awesome tunes from your totally legal song collection, and enjoy the fact that you can socialize without having to pay a $10 cover charge for the privilege.

5) Buy used textbooks

These days, it’s estimated that students in some faculties will have to shell out more than $1,000 for books per semester. This is truly insane, and while books have new editions every six months or so, they often change so little that students can buy them off each other for much less than what it cost new.